Billing FAQ

How does billing work?

If you subscribe to a monthly plan, you will be billed the same amount on the same day (unless you upgrade or downgrade your plan). For example, if you subscribe on the 15th of July, you will be billed on the 15th of each subsequent month.

If you have an annual plan, you will be billed on the same day each year.

Will I be billed per account or per website?

TLDR: We charge per account.

Our subscription tiers are based on the total number of page views, custom events (and other events such as CAPTCHA) of all the projects you create on our account, so you can add as many sites to Swetrix as you like, the total number of events across all of them will count as your total number of events towards your subscription tier.

All our subscription plans include up to 50 projects for free, for each additional project you will be charged $0.15 per project.

How do I access my invoices?

We use Paddle as our payment processor, which sends invoices by email, with a copy in the body of the email and a link to view the invoice on a hosted website.

Can I switch between monthly and yearly billing?

You can switch between monthly and annual billing at any time. For example, if you are halfway through your annual subscription and decide to switch to a monthly subscription, the price will be prorated to reflect what you have already paid.

What payment methods does Swetrix accept?

We accept credit/debit cards, PayPal, Google Pay and Apple Pay. All payments are processed securely through Paddle.

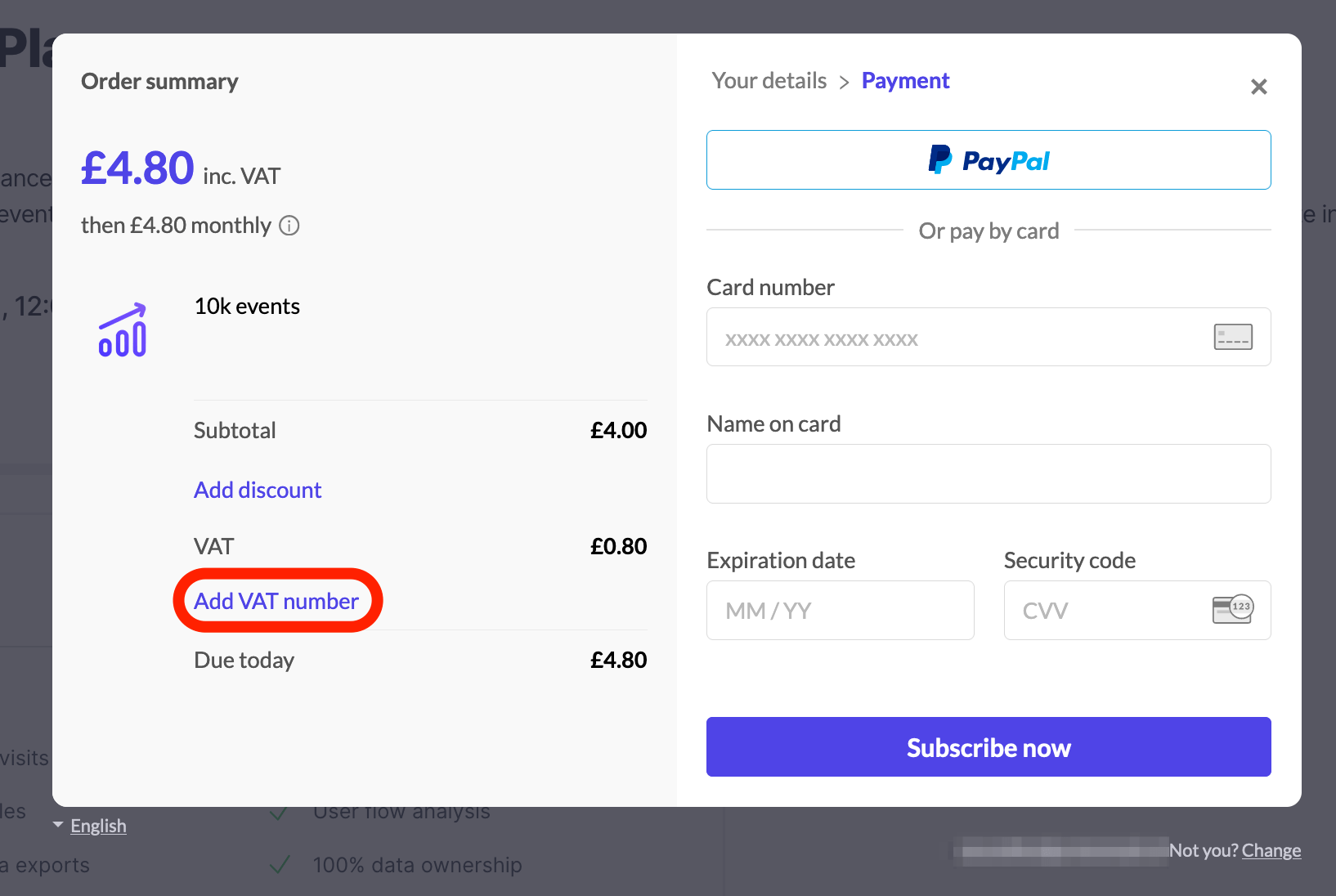

Can I get a VAT refund on my subscription?

You can add your company details and VAT ID when subscribing to one of our plans. If you're eligible, no VAT or other sales taxes will be added to your subscription price.

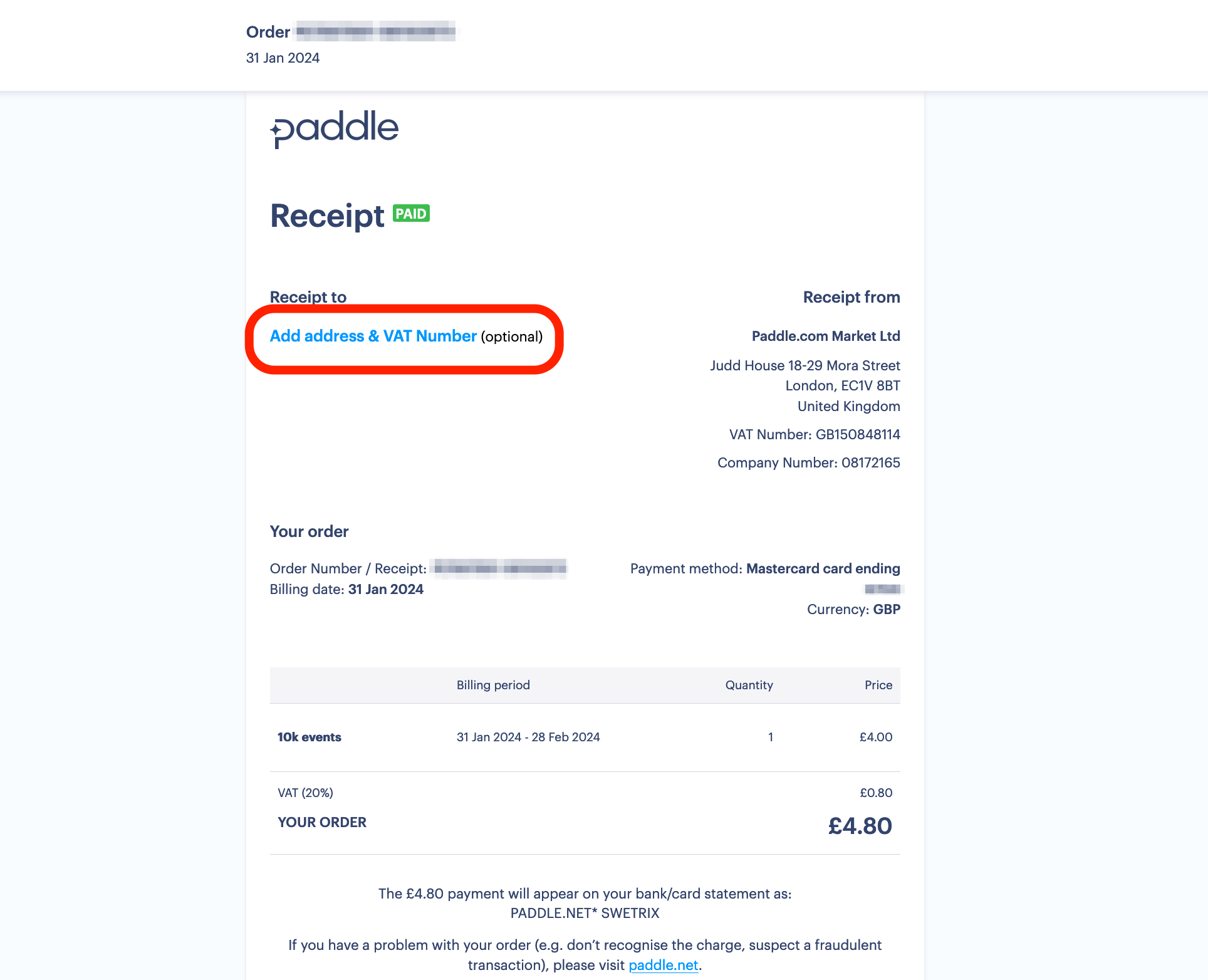

You can also add your VAT number after you created a subscription, to do that open the invoice Paddle sent you to your email address, and click on the "Add address & VAT Number" button.

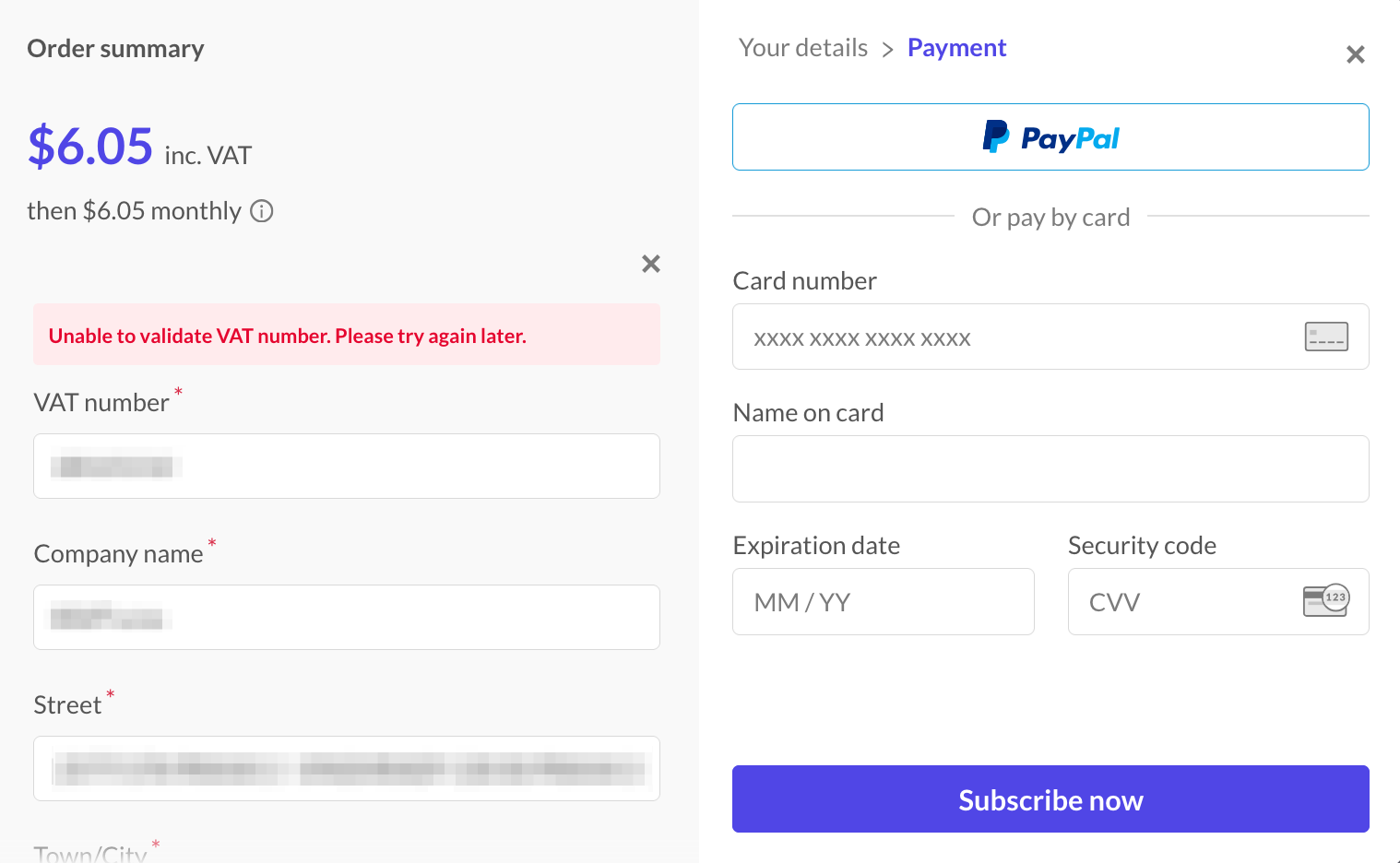

I am seeing "Unable to validate VAT number" error when adding my VAT number

If your VAT number has a country code prefix in it (e.g. "DE" in "DE123456789"), please remove it and try entering only the numbers.

The reason for this is that you are selecting the country code from the list of countries below, so the VAT number is validated separately. Our payment processor Paddle handles the VAT processing. Here is a list of VAT numbers formats accepted by Paddle.

If you are still having this issue, please contact us.

How can I update my payment information?

To update your billing information, log in to your account and go to the Billing page.There you will find an "Update payment details" button which will take you to the Paddle subscription management page where you can edit your payment details.

Help us improve Swetrix

Was this page helpful to you?